Since bottoming in February, TLT has meandered its way back up. U.S. equities have been running in place since then, the euro is a mess, and the economy has flatlined, leading to talk of a Japan-style "Lost Decade". Most importantly, the Fed has been printing money, and using it to mop up supply of U.S. treasuries, in order to keep borrowing costs low and stimulate the economy.

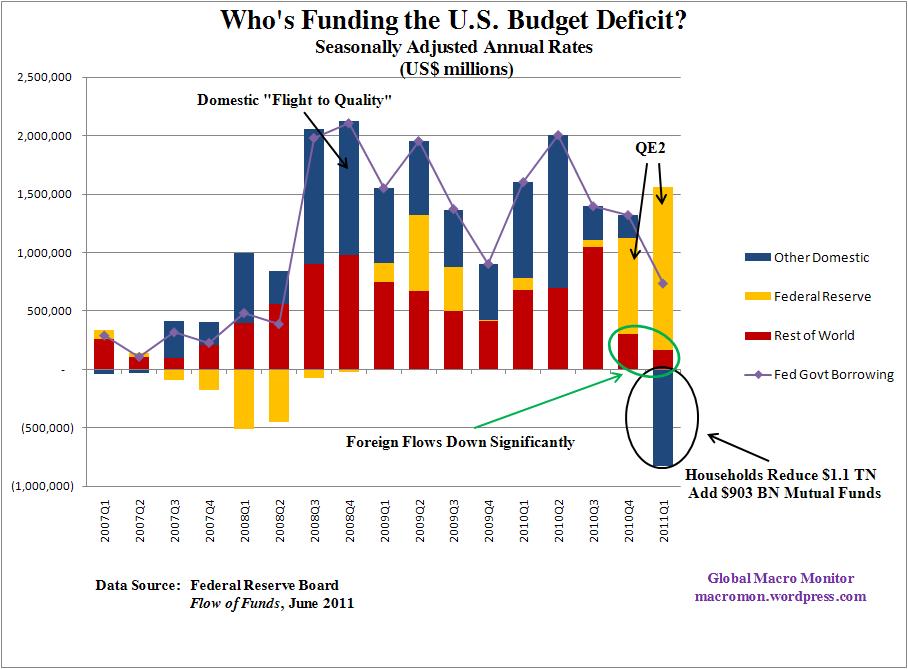

Who else is buying treasuries? As it turns out, nobody, as this chart from the Global Macro Monitor shows:

Bill Gross, Pimco's bond guru, has had his company out of treasuries since March. The Russians and Chinese, among others, consider US government debt radioactive (though the Chinese have recently resumed some lukewarm accumulation). American individual investors read the news from Washington every day, no way they're buyers. So, Ben Bernanke is backstopping the whole market...and he reiterated today that there would be no QE3 when QE2 expires at the end of this month!

So, why has TLT been drifting up recently, rather than heading down? After all, none of this is a secret. Well, the Eurozone is even more screwed up than the USA, so there's some "flight to quality" going on. Even though TLT doesn't really represent quality any more, old habits die hard. Secondly, the old saw "don't fight the Fed" has governed many market participants; even though Bernanke says there will be no QE3 people don't believe him. If things get bad enough, QE3 could be turned on as soon as enough

currency stock and green ink can be trucked in. Thirdly, Congress is a wildcard. The market thinks that there will eventually be a deal on the debt ceiling accompanied by spending cuts. When and if this happens, market participants don't want to be short US Debt. My feeling is that Congress will reach an 11th-hour deal, but it will be watered-down and short-term. It's impossible to reform our entitlement system on a short deadline, and both parties think they have staked out a winning position for next year's election.

Interesting clue in today's trading. Bernanke spoke at 2pm today and was quite downbeat on the economy, trimming growth estimates for this year and next. Normally, great news for the bond market; this time, nary a peep:

Like Sherlock Holmes, we can learn a lot from the dog that didn't bark. A market that doesn't rally on good news is destined to go down. This looks like a great time to enter "The Trade of the Decade" if you missed it late last year. If you need an extra adrenaline rush, buy TBT (Proshares UltraShort 20+ year Treasury ETF). If you prefer a more sedate lifestyle, short (or buy puts) on TLT.

Disclaimer: I'm short TLT as of this afternoon.

No comments:

Post a Comment