- Traffic is brutal! Normally, things start to slow down this time of year, as the college students leave town and the rest of us take vacations. Not this year...my commute going against traffic on 128 is usually 35-40 minutes. The last three weeks it has been over an hour. I've been doing this drive off-and-on for 20 years, and traffic has always been a very good economic indicator.

- Headhunters have been calling. As a computer hardware engineer, things were flying in the late '90's and even into 2000 and 2001. Then, it was as dry as the Sahara Desert for a few years. Now, there seems to be more demand than supply of experienced engineers in my field, as the phone and email have been buzzing.

- We're avid skiers, and own a small house in Vermont that we love to get away to whenever there's time. We also rent it on vrbo.com to help pay the bills. (Vermont is a wonderful but very socialist state, with a perverse system of paying for education, leading to ridiculous real estate tax bills in ski towns like Stowe. But that's for another blog post.) Our calendar is almost full this summer, far and away our best in the five years that we've had the house. We even raised prices, hoping to discourage bargain-hunters and save some weekends for our own use!

- My co-worker just moved to a bigger house in a better town. He sold his old house in four days: day 1, listing; day 2, broker tour; day 3, open house with multiple offers above asking; day 4, signed the papers. (added 6/29/11)

Tuesday, June 28, 2011

A report from the Framingham Fed

My personal economic indicators:

Wednesday, June 22, 2011

A second chance at the Trade of the Decade

Last September, Doug Kass called "The Trade of the Decade": short US long bonds. TLT was at 106-ish when he made the call; it dropped to 88 before trading recently around 97.

Tweet

Since bottoming in February, TLT has meandered its way back up. U.S. equities have been running in place since then, the euro is a mess, and the economy has flatlined, leading to talk of a Japan-style "Lost Decade". Most importantly, the Fed has been printing money, and using it to mop up supply of U.S. treasuries, in order to keep borrowing costs low and stimulate the economy.

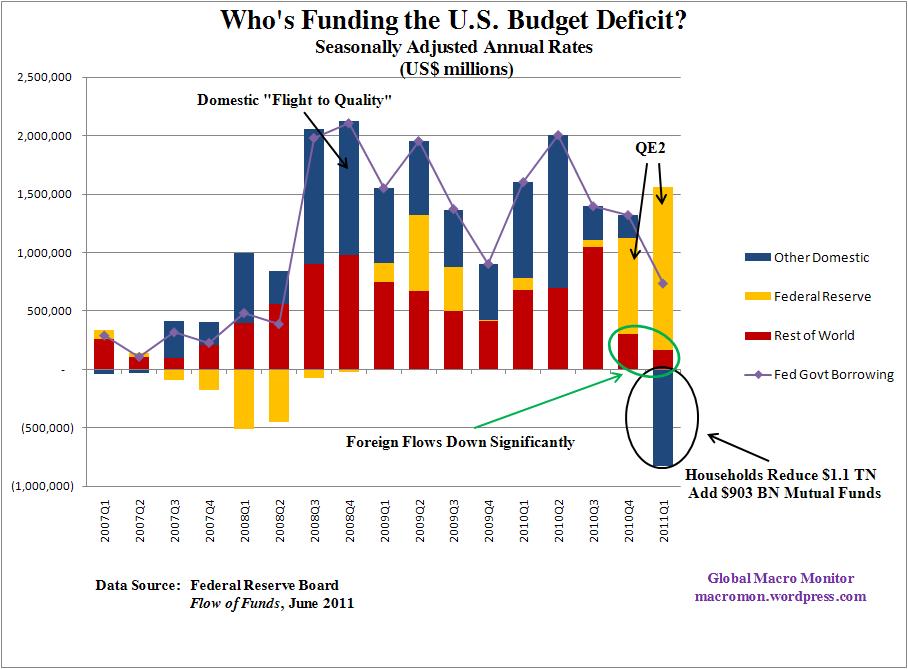

Who else is buying treasuries? As it turns out, nobody, as this chart from the Global Macro Monitor shows:

Bill Gross, Pimco's bond guru, has had his company out of treasuries since March. The Russians and Chinese, among others, consider US government debt radioactive (though the Chinese have recently resumed some lukewarm accumulation). American individual investors read the news from Washington every day, no way they're buyers. So, Ben Bernanke is backstopping the whole market...and he reiterated today that there would be no QE3 when QE2 expires at the end of this month!

So, why has TLT been drifting up recently, rather than heading down? After all, none of this is a secret. Well, the Eurozone is even more screwed up than the USA, so there's some "flight to quality" going on. Even though TLT doesn't really represent quality any more, old habits die hard. Secondly, the old saw "don't fight the Fed" has governed many market participants; even though Bernanke says there will be no QE3 people don't believe him. If things get bad enough, QE3 could be turned on as soon as enough

currency stock and green ink can be trucked in. Thirdly, Congress is a wildcard. The market thinks that there will eventually be a deal on the debt ceiling accompanied by spending cuts. When and if this happens, market participants don't want to be short US Debt. My feeling is that Congress will reach an 11th-hour deal, but it will be watered-down and short-term. It's impossible to reform our entitlement system on a short deadline, and both parties think they have staked out a winning position for next year's election.

Interesting clue in today's trading. Bernanke spoke at 2pm today and was quite downbeat on the economy, trimming growth estimates for this year and next. Normally, great news for the bond market; this time, nary a peep:

Like Sherlock Holmes, we can learn a lot from the dog that didn't bark. A market that doesn't rally on good news is destined to go down. This looks like a great time to enter "The Trade of the Decade" if you missed it late last year. If you need an extra adrenaline rush, buy TBT (Proshares UltraShort 20+ year Treasury ETF). If you prefer a more sedate lifestyle, short (or buy puts) on TLT.

Disclaimer: I'm short TLT as of this afternoon.

Tuesday, June 14, 2011

How to Trade a Greek Default

In a thought-provoking piece, Andrew Lilico writes:

So, the market should be discounting the likelihood of default when valuing the Euro...is it? Here's a chart of the Euro vs US Dollar:

Ooops, the Euro is strengthening when it should be weakening...why? My guess is the market is more worried about US Govt. debt than it is about Greek debt. Let's compare the Euro to a couple of resource-backed currencies issued by countries with comparatively strong finances, Australia and Canada, and to the Swiss Franc, a traditionally strong currency:

We see that the market has discounted EUR against each of these currencies to some degree...long CHF/ short EUR has been a huge win since Greek debt started to plunge in late 2009. Europe's elite saw the writing on the wall, sold their euros in favor of the good old Swiss Franc. (Switzerland's banks are not free of problems, but that's a story for another day. Just being outside the Eurozone seems to be good enough.)

How long will this currency trend continue? Until the market perceives a resolution of some kind is coming. Given policymakers' fondness for "kicking the can down the road", I don't see this happening soon. Greece is out of options, and its politicos are whispering about leaving the Eurozone (many Northern Europeans would wish them good riddance).

One solution making the rounds recently: extend maturities on Greek debt, reducing current interest payments and buying time for the Greek Government to come up with more cash through cost-cutting, more efficient tax-collecting, and asset sales. A couple of problems with this scenario: recent austerity measures have caused massive dislocation in Greece--skyrocketing unemployment, striking employees, and angry protests. GDP is shrinking. How will Greece be better positioned to pay its debts in a few years than it is now? And how will angry, unemployed Greeks feel about the Acropolis being sold to the highest bidder? Sounds like more "can-kicking" to me.

Bottom line: short the Euro on rallies against one of the safe-haven currencies (AUD and CHF look best). Be very careful with CHF, however, as Switzerland's proximity to the Eurozone is likely to cause a furious counter-rally after Lilico's dominoes start to fall. Tweet

"What happens when Greece defaults. Here are a few things:Whether or not you believe Lilico's full cause-and-effect chain, it's clear that a Greek default will not be good for the euro or the core eurozone countries (principally Germany and France). Greece's problems are well documented; indeed, the market's opinion of Greek government debt seems to be falling by the day, with the 10-year yielding 16.72% as I write this.

- Every bank in Greece will instantly go insolvent.

- The Greek government will nationalise every bank in Greece.

- The Greek government will forbid withdrawals from Greek banks.

- To prevent Greek depositors from rioting on the streets, Argentina-2002-style (when the Argentinian president had to flee by helicopter from the roof of the presidential palace to evade a mob of such depositors), the Greek government will declare a curfew, perhaps even general martial law.

- Greece will redenominate all its debts into “New Drachmas” or whatever it calls the new currency (this is a classic ploy of countries defaulting)

- The New Drachma will devalue by some 30-70 per cent (probably around 50 per cent, though perhaps more), effectively defaulting 0n 50 per cent or more of all Greek euro-denominated debts.

- The Irish will, within a few days, walk away from the debts of its banking system.

- The Portuguese government will wait to see whether there is chaos in Greece before deciding whether to default in turn.

- A number of French and German banks will make sufficient losses that they no longer meet regulatory capital adequacy requirements.

- The European Central Bank will become insolvent, given its very high exposure to Greek government debt, and to Greek banking sector and Irish banking sector debt.

- The French and German governments will meet to decide whether (a) to recapitalise the ECB, or (b) to allow the ECB to print money to restore its solvency. (Because the ECB has relatively little foreign currency-denominated exposure, it could in principle print its way out, but this is forbidden by its founding charter. On the other hand, the EU Treaty explicitly, and in terms, forbids the form of bailouts used for Greece, Portugal and Ireland, but a little thing like their being blatantly illegal hasn’t prevented that from happening, so it’s not intrinsically obvious that its being illegal for the ECB to print its way out will prove much of a hurdle.)

- They will recapitalise, and recapitalise their own banks, but declare an end to all bailouts.

- There will be carnage in the market for Spanish banking sector bonds, as bondholders anticipate imposed debt-equity swaps.

- This assumption will prove justified, as the Spaniards choose to over-ride the structure of current bond contracts in the Spanish banking sector, recapitalising a number of banks via debt-equity swaps.

- Bondholders will take the Spanish Banking Sector to the European Court of Human Rights (and probably other courts, also), claiming violations of property rights. These cases won’t be heard for years. By the time they are finally heard, no-one will care.

- Attention will turn to the British banks. Then we shall see…

So, the market should be discounting the likelihood of default when valuing the Euro...is it? Here's a chart of the Euro vs US Dollar:

We see that the market has discounted EUR against each of these currencies to some degree...long CHF/ short EUR has been a huge win since Greek debt started to plunge in late 2009. Europe's elite saw the writing on the wall, sold their euros in favor of the good old Swiss Franc. (Switzerland's banks are not free of problems, but that's a story for another day. Just being outside the Eurozone seems to be good enough.)

How long will this currency trend continue? Until the market perceives a resolution of some kind is coming. Given policymakers' fondness for "kicking the can down the road", I don't see this happening soon. Greece is out of options, and its politicos are whispering about leaving the Eurozone (many Northern Europeans would wish them good riddance).

One solution making the rounds recently: extend maturities on Greek debt, reducing current interest payments and buying time for the Greek Government to come up with more cash through cost-cutting, more efficient tax-collecting, and asset sales. A couple of problems with this scenario: recent austerity measures have caused massive dislocation in Greece--skyrocketing unemployment, striking employees, and angry protests. GDP is shrinking. How will Greece be better positioned to pay its debts in a few years than it is now? And how will angry, unemployed Greeks feel about the Acropolis being sold to the highest bidder? Sounds like more "can-kicking" to me.

Bottom line: short the Euro on rallies against one of the safe-haven currencies (AUD and CHF look best). Be very careful with CHF, however, as Switzerland's proximity to the Eurozone is likely to cause a furious counter-rally after Lilico's dominoes start to fall. Tweet

Subscribe to:

Posts (Atom)