August 3, 2011: The Day the Fiat Currency Died. It's not as poetic as

, and Don McClean won't be writing any hit songs about it, but it is a milestone in financial history. For on 8/3, Switzerland became the last of the strong money countries to throw in the towel, as they lowered rates “as close to zero as possible” in order to weaken the Franc and improve Switzerland's competitive position. The prim-and-proper, all business, tight-money Swiss have given up the ghost. There are now no safe haven currencies left.

It all started with the Asian economies, principally China and India. China has become an export powerhouse by pegging the yuan to the dollar at an ridiculously low exchange rate. Of course, China's gain is the rest of the world's loss, as manufacturing jobs have been lost all over the world to China and other East Asian countries that have emulated China's policies. India has been just as effective at importing jobs by adopting the same strategy, only India's strength is in the service sector: customer support, engineering, legal services, etc.

What is the magnitude of this currency manipulation? Economists estimate that the yuan is about 50% undervalued compared to the dollar. The Economist magazine has just updated it's

Big Mac Index, and a Big Mac costs just $2.27 in China.and $1.89 in India*! This sandwich will set you back $4.07 in the U.S. (too damn much, IMHO) and $8.06 in Switzerland! No wonder the Swiss decided to weaken their currency; the Swiss love them some Big Macs! (Big Mac arbitrage, anybody? All you need is a few hundred yuan, a big suitcase, and a one-way ticket from Beijing to Geneva.)

While the world economy grew, the USA looked the other way. Sure, we lost jobs to Asia, but the economy was growing, Wall Street was getting rich, home values were soaring, and corporate profits were surging. And (maybe most importantly), presidents, senators, and representatives were being re-elected.

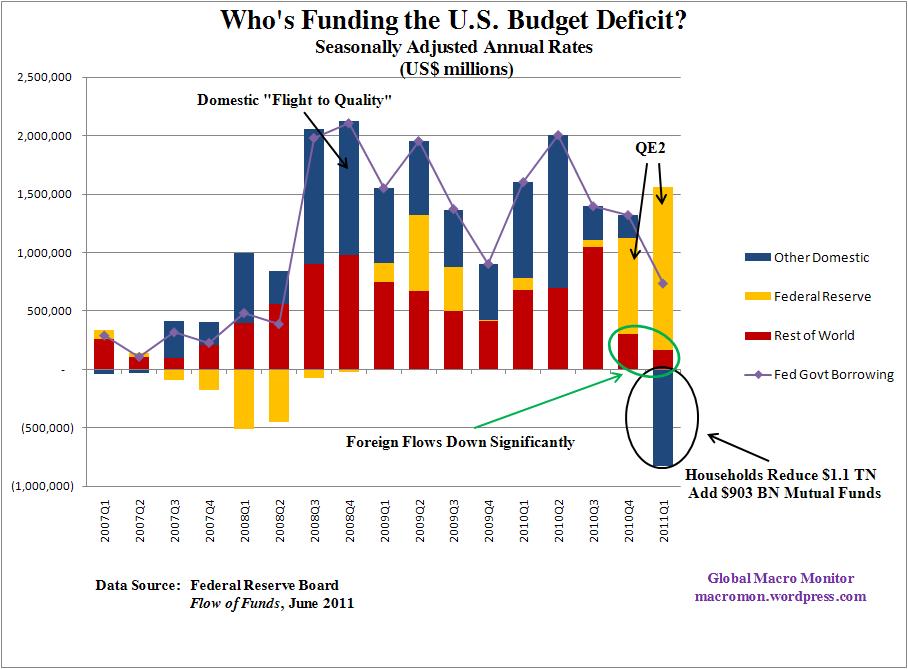

That all changed in 2008. The world plunged into The Great Recession, featuring the worst job losses since the 1930's. Rich-world GDP plunged, while China and India continued to grow. Helicopter Ben Bernanke, Tim Geithner, and President Obama pulled out all the stops: they turned the Mint's printing presses up to 11, orchestrated QE and QE2 to drive both short- and long-term interest rates into the dirt, and flooded the world with dollars. The hope was that this would prop up housing prices, get businesses to invest and hire again, and restart the economy. (It hasn't really worked, as housing prices bounce along the bottom and much of the new investment has taken place in China. But that's a story for another day.)

Europe was faced with many of the same challenges, but with a twist. Creation of a common currency had encouraged reckless borrowing by the less-productive members of the Eurozone (the so-called PIIGS). As I write this, Europe is enmeshed in a full-fledged currency crisis. Greece is broke and has no chance to repay large loans from big European banks. Portugal, Italy, Ireland, and Spain are vying for second place in the race to the bottom. Consequently, the Euro is in mortal danger, and has dropped like a stone since 2008 against the Yen, Franc, and gold. Nobody believes in the Euro anymore, and the smart money has left town.

Now that the Swiss have given up, where can cash be safely stashed? The dollar? Fuggetaboutit. The Euro? See above. The Yen? Only because Japan has been in the ditch for 20 years, and have gotten comfortable there. You'll get no yield there. The Canadian and Australian Dollars, or the Brazilian Real? Maybe, but they're totally levered to commodity prices. The "full faith and credit" of the USA isn't what it used to be, but we haven't sunk below Brazil yet, have we? In the early '80's, Brazil converted the Crusado to the Cruizero by stamping "000" on their paper money...I kid you not! When the Fed stamps "000" on Dollars and starts calling them Dollaroos, I'll move my meager savings to Brazil.

So what does that leave? Nothing! There are no reliable currencies left, where you can relax in cash and get paid a small amount of interest to wait.

Wait a minute, I forgot about one currency...gold! The has represented money since before it was called money. It's heavy, clunky, and you can't buy a Big Mac with it, but it has held it's value better than any currency the last ten years. Of course, it yields nothing and is difficult to store. But today, one can buy electronic versions of gold (as easy to store as cash) and the non-existent yield matches the Dollar, Swiss Franc, and Yen.

Here's a couple of interesting graphs. First, a few commodities priced in Dollars:

Corn and copper have more than doubled since 6/2010 and oil has been flat, indicating a healthy world economy. Not so fast...here are the same commodities priced in gold:

Corn and copper are still up, but oil is down a third since March, and both copper and oil have fallen off a cliff the last two weeks. The market smells a recession coming! US Treasuries have rallied strongly and the stock market is down 8 days in a row, further signs of a coming recession.

Gold is the new cash! Keep your idle savings in gold, rather than one of the fiat currencies. It will preserve your purchasing power without geopolitical risk, earthquake risk, tsunami risk, Obama risk, Bernanke risk, Merkel risk, or Greek risk.

*Actually, it's called the "Maharaja Mac" in India, presumably containing no beef. Sounds gross.